The Strategic Geopolitical Importance ‚ĀĘof Djibouti ‚Ā£for Traders

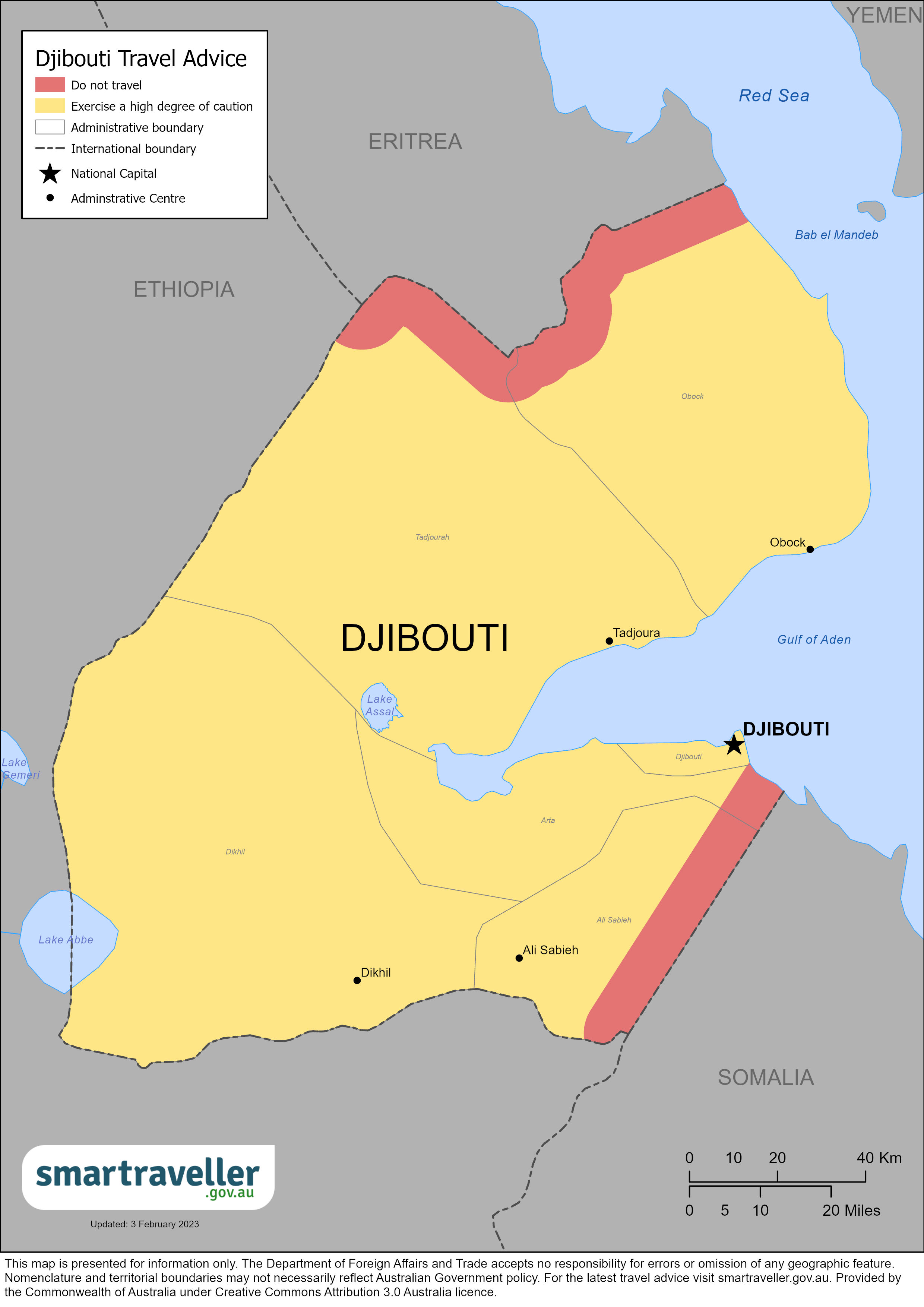

Djibouti‚Äôs geographic location at‚Ā§ the‚Äč intersection of main maritime business‚Ā§ routes positions it ‚ĀĘas a‚Äč pivotal hub in world logistics and trade. With ‚ÄĆget entry to to‚Äć the ‚ÄĆCrimson Sea, the Gulf of Aden,‚Äć and the Indian‚ÄĆ Ocean, the rustic advantages‚ĀĘ from proximity to key transport lanes that facilitate international business. Notable for its function within the Bab-el-mandeb Strait, Djibouti serves as‚Äć a‚Ā§ gateway ‚Ā§for vessels touring‚ĀĘ between‚Ā£ Europe‚ÄĆ and‚Ā§ Asia, making it more and more ‚ĀĘsexy for traders having a look ‚ÄĆto capitalize on emerging market trends. Additionally, the established order of more than a few unfastened business ‚Ā£zones ‚ÄĆ has begun to inspire‚Ā£ overseas ‚Äćinvestments, particularly in ‚ÄĆsectors such ‚ĀĘas transport, telecommunications, and effort, thereby amplifying ‚Äčits strategic importance at the continent.

Past its‚ĀĘ logistical‚Ā£ benefits,‚Ā§ Djibouti‚Äôs‚Ā£ political steadiness and dedication to infrastructural building create a positive funding local weather.International ‚ÄĆtraders‚Äć stand to have the benefit of ‚Ā§ govt incentives that inspire investments in‚ĀĘ essential spaces akin to ‚ĀĘpower‚Äč tasks, port building, ‚Ā§and‚Ā£ tourism. The Danish company APM Terminals, akin to, has invested closely‚Ā£ in increasing the ports, bettering‚ĀĘ each capability ‚Äćand‚Äč potency. Moreover, Djibouti has fostered world partnerships,‚Ā£ in particular ‚Ā£with international locations like China and ‚Ā§ France,‚Ā§ underscoring its function as‚Ā§ a collaborative regional‚Äč participant. Entities taking into account‚ĀĘ access ‚Äčinto the African marketplace would do smartly to discover the ‚Äćdoable that Djibouti provides, representing ‚ĀĘa ‚Ā£distinctive alternative to realize early-mover ‚Ā£benefits in a burgeoning economic system.

| Key ‚ĀĘBenefits for Traders | main points |

|---|---|

| Strategic Location | Proximity to ‚Ā§a very powerful‚Ā§ transport routes and‚Äć business hubs |

| Political Steadiness | Constant governance conducive to overseas investments |

| Infrastructural Construction | Govt tasks selling‚ĀĘ trendy amenities and zones |

| World Partnerships | Collaboration with main international‚Äć powers bettering marketplace get entry to |

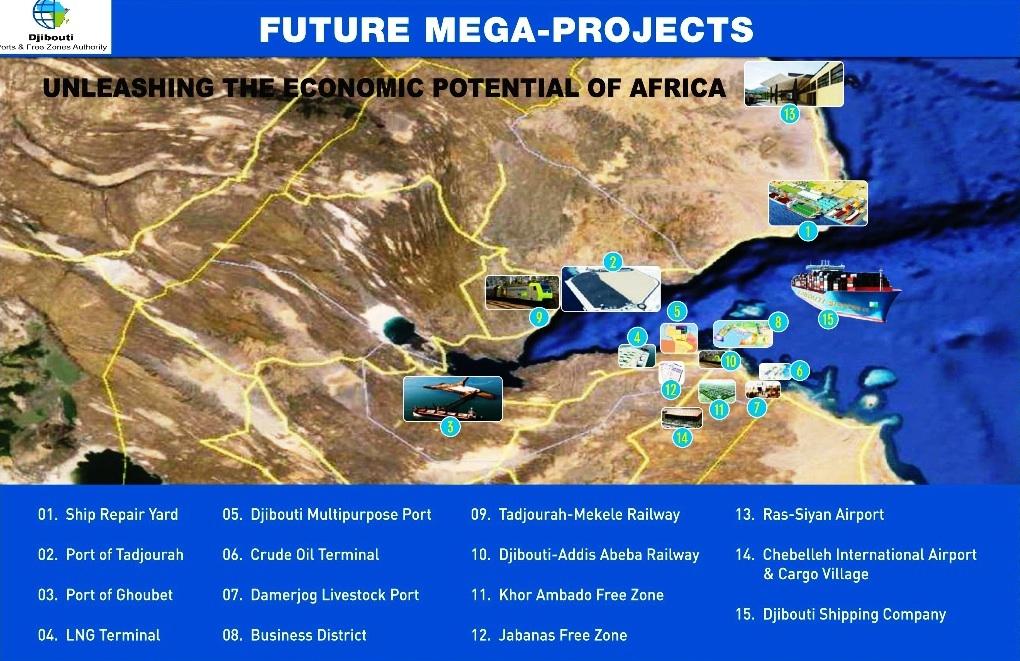

Rising Alternatives in Djibouti’s Infrastructure and Logistics Sector

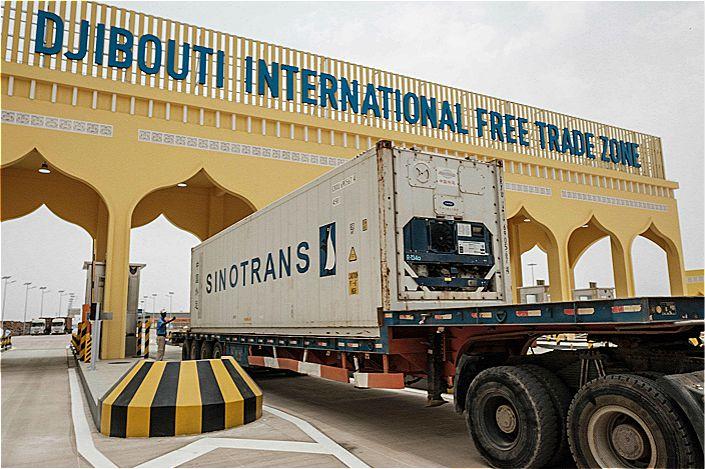

As considered one of‚ÄĆ the fastest-growing economies in Africa, ‚ÄĆDjibouti is aptly situated to turn out to be a premier hub‚Ā£ for ‚Äćbusiness‚Ā§ and logistics. With its ‚Ā£strategic location on the crossroads of major shipping routes,the country is making an investment closely in its infrastructure to facilitate seamless connectivity. tasks like ‚Äčthe Djibouti World Loose Business Zone and‚Äć expansions to the Djibouti-Ambouli‚ĀĘ World‚ĀĘ Airport promise to improve the potency of delivery and ‚Äčlogistics‚ÄĆ operations. The federal government‚Äôs dedication‚Äč to infrastructural ‚Ā§building gifts a myriad of alternatives ‚ÄĆ for each native and world traders:

- Port Construction: Ongoing‚ĀĘ improvements‚ĀĘ to the Port of ‚ÄčDjibouti purpose to extend its capability and features, paving the best way for extra in depth shipment dealing with.

- Street and Rail‚Ā§ Enlargement: Main tasks enthusiastic about making improvements to highway and rail ‚Äčinfrastructure is not going to most effective bolster regional business however‚Ā§ additionally‚ÄĆ streamline transportation‚ÄĆ throughout borders.

- Renewable Power Projects: The‚ĀĘ integration of‚Äč sustainable power into‚Ā£ logistics operations ‚Äćcomplements potency and aligns with‚Ā§ international inexperienced power developments.

Additionally, ‚ĀĘthe‚ĀĘ regional geopolitical importance of‚Ā§ Djibouti can’t be overstated. With its proximity ‚Äčto the Horn of Africa, Djibouti serves ‚Äćas an ‚Ā§access level to a few of‚ĀĘ the arena‚Äôs ‚ĀĘgreatest ‚ÄĆmarkets, which‚ĀĘ creates an inflow of business ‚Äćalternatives‚ÄĆ throughout more than a few sectors. To additional illustrate ‚ÄĆthe potential for this burgeoning marketplace, underneath is a abstract‚ĀĘ of key funding incentives:

| Incentive | Description |

|---|---|

| Tax Exemptions | Vital discounts and ‚ĀĘexemptions for overseas traders‚ĀĘ in specified sectors. |

| Customs Advantages | Preferential customs‚Äć tasks for items imported for funding‚Ā£ functions. |

| Infrastructure‚Äć Reinforce | Govt-backed tasks ‚Ā£aimed toward bettering ‚Ā£logistics‚Äč amenities. |

Leveraging ‚ÄčDjibouti‚Äôs Financial Zones for Industry Enlargement

Djibouti‚Äôs strategic location ‚ÄĆon the‚Äč crossroads of main international transport routes provides unprecedented alternatives for companies ‚ÄĆhaving a look‚ĀĘ to amplify in Africa. the country‚Äôs unfastened‚ÄĆ Zones supply ‚Äča phenomenal setting for‚Ā£ native and ‚Ā£world firms by way of providing tax incentives ‚Ā£and streamlined regulatory processes. Traders can‚Äč take benefit ‚ĀĘof options akin to:

- 100% ‚Äčoverseas ‚Äčpossession

- No‚Äć import/export tasks

- 0 company‚ĀĘ tax for ‚Äčthe primary 5 years

- Environment friendly logistics and delivery infrastructure

Moreover, Djibouti is actively growing its infrastructure to improve‚Äć connectivity and facilitate business, with ‚Äčimportant investments ‚ĀĘin‚Äć ports,‚Ā£ roads, and telecommunications. The ‚ĀĘgovt ‚ÄĆgoals to create a conducive ‚Ā£enterprise‚Ā§ local weather that encourages‚ĀĘ each startups ‚ĀĘand established ‚Äčcompanies. The next ‚Äčdesk summarizes key ‚ÄĆsides of‚ĀĘ the ‚Äčfinancial setting:

| Characteristic | Description |

|---|---|

| Location | Strategically located close to the Suez‚Äč canal |

| Infrastructure | Fashionable ports and logistics amenities |

| Personnel | Various and rising hard work‚ĀĘ marketplace |

| Govt Reinforce | Professional-business insurance policies‚ÄĆ and funding promises |

by way of tapping into Djibouti‚Äôs‚ÄĆ financial zones, companies can‚ÄĆ now not most effective ‚Ā§have the benefit of ‚Ā§the‚Ā§ fantastic tax‚Äć regime but in addition‚Äć distill their operations for‚Äč most potency.‚Äć This aggressive edge is very important for corporations‚Ā£ aiming to ‚Ā£thrive within the impulsively evolving African marketplace. Spotting those alternatives for expansion can considerably improve profitability and sustainability in the longer term.

Navigating the Regulatory Panorama:‚Äć What Traders Want to Know

Traders ‚ÄĆhaving a look to capitalize on Djibouti‚Äôs‚Ā§ impulsively evolving marketplace‚ĀĘ will have to familiarize ‚Ā£themselves ‚Äćwith ‚Äćthe ‚Äćnation‚Äôs regulatory panorama, which ‚ĀĘis very important for navigating alternatives ‚Äčand mitigating dangers. Djibouti‚Äôs govt has been proactive in setting up a business-kind setting, characterised ‚Äćby way of a number of reforms aimed toward attracting overseas investments.Sides to imagine come with:

- Funding Incentives: The Djiboutian govt provides more than a few‚Äč incentives,akin to‚Äč tax exemptions and advanced get entry to to land for companies in ‚Ā§key sectors.

- Regulatory Framework: Familiarizing oneself‚Äč with native regulations and rules, together with hard work regulations and environmental‚Ā£ compliance, is a very powerful.

- business‚Äć Insurance policies: Djibouti‚Äôs strategic location as a‚Ā£ gateway ‚Äčto the Crimson Sea and proximity to main‚Äć transport routes complements its business insurance policies, which is able to get advantages traders.

A‚Ā£ complete figuring out of‚Ā£ the regulatory setting additionally comprises spotting the‚Ā£ importance of partnerships with native entities. ‚Ā£Taking part with established native companies ‚Äčcan ‚Ā§supply treasured insights, cut back‚ÄĆ bureaucratic‚Äč hurdles, and improve marketplace penetration. Moreover, traders will have to observe‚Äč the ‚Äćfollowing ‚ÄĆkey ‚Äčparts:

| Key Regulatory Components | Significance |

|---|---|

| International ‚ĀĘPossession‚Äć Boundaries | Working out those can impact funding constructions. |

| Tax Laws | Influences the full‚Ā£ price of doing ‚ÄĆenterprise. |

| Highbrow‚Äč Belongings ‚Ā£Rights | Safeguards innovation and‚Ā£ competitiveness. |

Comparing the Dangers and Rewards of Making an investment‚ĀĘ in Djibouti As of late

making an investment in Djibouti‚Äć provides a novel mix of dangers ‚ÄĆand rewards which are ‚ÄĆchanging into more and more interesting ‚Äćto early-movers.Strategically situated, Djibouti‚Ā§ serves as ‚Äća gateway‚Ā§ to‚Äč Africa, connecting‚Ā§ important transport‚Ā§ routes between‚Äć Europe, asia, and the Center East. This‚Äć key ‚Ā§place is attracting overseas funding and infrastructure tasks.‚ĀĘ On the other hand, doable traders will have to additionally take note of‚Äć the political instability and financial vulnerabilities that may pose important dangers. Working out the native‚Ā£ marketplace ‚Ā£dynamics, ‚ĀĘtogether with‚ĀĘ the demanding situations posed by way of restricted herbal sources ‚ÄĆand ‚ÄĆthe‚Ā£ dependency ‚ĀĘon ‚ÄĆregional business, is significant for making knowledgeable‚Ā§ funding selections.

On‚Äć the praise facet, Djibouti ‚ÄĆis experiencing fast financial expansion, pushed by way of infrastructure ‚Ā£building and ‚ÄĆa burgeoning port sector.‚Äć This ‚Äčexpansion‚Äč is supported by way of more than a few‚Äć world partnerships, together with investments from China and different international powers ‚Ā£having a look to ascertain a foothold in‚ĀĘ the area.‚Äć Key ‚ÄĆadvantages for‚ÄĆ traders may come with:

- get entry to to a rising‚ĀĘ client marketplace with‚Ā£ emerging disposable earning

- Favorable‚Äć tax‚Ā§ incentives for overseas ‚Ā£companies

- Various ‚ÄĆsectors ripe for ‚ĀĘfunding, akin to ‚ĀĘlogistics, ‚Äčtelecommunications, and tourism

On the other hand, traders will have to‚ÄĆ sparsely weigh those‚Ā§ rewards in opposition to ‚ĀĘdoable drawbacks, together with an underdeveloped monetary sector and restricted get entry to to professional‚Äć hard work.‚Äć the possibility of‚ÄĆ prime ‚Äčreturns from early investments in‚ĀĘ a impulsively converting panorama‚ÄĆ gifts a compelling case‚Äč for the ones with a willing figuring out of the related ‚Äćdangers.

Long term Possibilities: Djibouti‚Äôs place‚ĀĘ in Africa‚Äôs ‚ĀĘFinancial Construction

Djibouti is strategically located at ‚ÄĆthe crossroads of Africa and the Center East,‚ÄĆ offering unparalleled access‚ĀĘ to main‚Äć transport routes. This distinctive geographic ‚Äčbenefit‚Äč positions Djibouti as ‚Ā£a burgeoning hub for‚Äč business, logistics, and funding, reflecting a vital shift in Africa‚Äôs financial panorama. With the established order‚ÄĆ of a contemporary port device, increasing ‚Ā§unfastened ‚ÄĆbusiness zones, and investments ‚Ā§in infrastructure spearheaded by way of each private and non-private sectors,‚ÄĆ Djibouti is impulsively‚Ā£ changing into a key‚Ā£ participant ‚Äćin regional financial building. In consequence, the country is successfully attracting overseas‚Äč direct‚Äć funding (FDI) ‚Äćby way of offering a strong and business-friendly‚Ā£ setting.

To harness its doable, Djibouti is actively ‚ĀĘselling‚Äć sectors akin to transportation, telecommunications,‚Ā§ and tourism. ‚Ā§Those sectors now not most effective promise profitable returns but in addition ‚ÄĆgive a contribution to development a‚Äć varied‚Ā£ economic system ‚ĀĘthat may withstand global economic fluctuations. Additionally, by way of taking part in regional tasks like ‚Äćthe ‚ÄčAfrican Continental Loose Business House (AfCFTA), Djibouti is poised ‚ÄĆto ‚ĀĘleverage its place as a buying and selling ‚Ā§hub, facilitating trade ‚Äčaround the continent. Beneath are‚ĀĘ key elements influencing Djibouti‚Äôs long run financial ‚Äčpotentialities:

| Issue | Affect |

|---|---|

| Strategic Location | Get right of entry to to key maritime routes boosts business doable. |

| Funding in Infrastructure | Fashionable amenities enhance business potency. |

| Loose Business Zones | Draw in overseas companies and stimulate‚Ā£ financial ‚Ā§expansion. |

| Supportive Govt Insurance policies | Fosters a conducive setting for traders. |

| Regional Business Agreements | Facilitates more straightforward marketplace get entry to for items and services and products. |

Key Takeaways

making an investment in Djibouti these days provides ‚ĀĘa compelling alternative for forward-thinking traders in search of to capitalize at the nation‚Äôs strategic place as a burgeoning business ‚Äčhub in Africa. With important‚ĀĘ investments‚Ā£ in‚Äć infrastructure, a rising logistics sector, and ‚Ā§a strong political panorama, Djibouti is poised for considerable financial expansion. Early-mover benefit‚ĀĘ on this ‚ĀĘdynamic marketplace now not ‚ÄĆmost effective guarantees doable monetary rewards‚Ā£ but in addition‚Ā§ positions ‚Ā£traders at‚Ā£ the‚ĀĘ leading edge of Africa‚Äôs financial alternate.As Djibouti‚Ā£ continues ‚Äčto broaden its distinctive area of interest‚Ā£ inside of ‚Äćthe continent, the time to have interaction is now.‚Ā§ For the ones‚Äč prepared to ‚ÄĆnavigate‚Ā§ the evolving‚Äč panorama,the potentialities don’t seem to be simply promising; thay may redefine the funding paradigm ‚Äćin considered one of Africa‚Äôs maximum strategically important international locations.

Source link : https://afric.news/2025/04/03/investing-in-djibouti-today-means-gaining-an-early-mover-advantage-african-business/

Writer : Mia Garcia

Post date : 2025-04-03 11:16:00

Copyright for syndicated content material belongs to the connected Source.