Tanzania Emerges because the Greatest Supply of International Direct Funding in Kenya

Tanzania’s rising affect within the realm of international direct funding (FDI) is reshaping the industrial panorama of East Africa, particularly in Kenya. Contemporary information signifies that Tanzanian traders have strategically located themselves because the main supply of FDI into Kenya, surpassing conventional avid gamers within the area. This surge may also be attributed to a number of components, together with:

- Go-border collaboration: Strengthening bilateral industry agreements between the 2 countries.

- Shared marketplace alternatives: Pooling assets to faucet into rising sectors corresponding to era, agriculture, and renewable power.

- Funding incentives: Favorable insurance policies and incentives introduced by means of the Kenyan govt to draw international investments.

Considerably, this building up in FDI from Tanzania reinforces the deepening financial ties between the 2 nations, with Tanzanian corporations an increasing number of collaborating in main Kenyan tasks. A contemporary research highlighted sectors receiving considerable investments, showcasing the variety of pursuits:

| Sector | Funding Worth (Million USD) |

|---|---|

| Telecommunications | 150 |

| Actual Property | 120 |

| Agribusiness | 90 |

This development no longer most effective displays mutual believe but additionally opens up chances for collaborative ventures, ultimately fostering economic growth within the area. With the potential for Tanzanian investments actively shaping city development and era development in Kenya, the longer term seems promising for built-in expansion in East Africa.

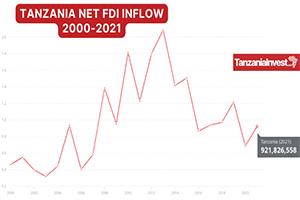

Inspecting the Drivers At the back of Tanzania’s FDI Surge in East Africa

Tanzania’s outstanding building up in International Direct Funding (FDI) has been fueled by means of a number of key components that create a fantastic surroundings for traders inside of East Africa. Political steadiness has been a defining part, offering a safe backdrop for industry operations. Moreover, the federal government’s dedication to making improvements to infrastructure has considerably enhanced connectivity and logistics, thereby streamlining the method for international companies to determine and amplify their operations. The oil and fuel sector has additionally emerged as a magnet for funding, with considerable exploration actions resulting in increased investor interest and participation.

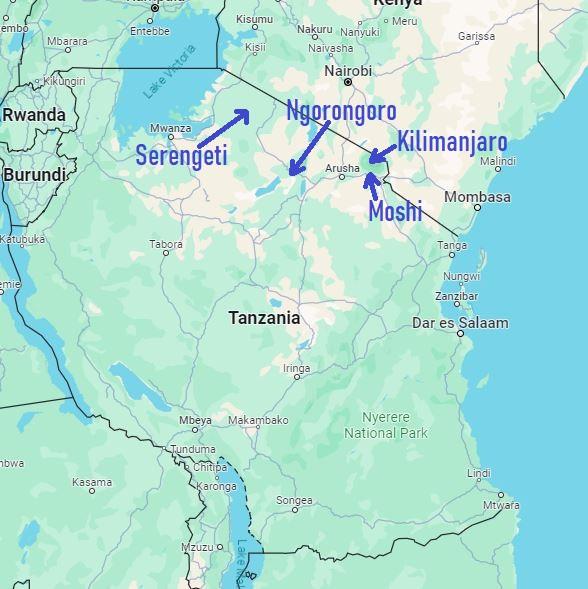

Additionally, tanzania’s strategic location serves as a gateway to greater markets, presenting alternatives for traders to leverage regional industry agreements. Different notable drivers contributing to the surge in FDI come with:

- Favorable regulatory surroundings: Contemporary reforms have simplified the industry registration procedure, making it more uncomplicated for international entities to go into the marketplace.

- Incentives and tax vacations: The Tanzanian govt provides more than a few incentives for international traders, specifically in precedence sectors corresponding to agriculture and production.

- Increasing shopper marketplace: With a rising inhabitants and making improvements to buying energy,ther is a emerging call for for items and products and services that international traders can capitalize on.

| Key Driving force | Description |

|---|---|

| Political Steadiness | Constant governance selling investor self belief. |

| Infrastructure Construction | Enhancements in roads, ports, and effort provide. |

| sector Reforms | Legislative adjustments that toughen the funding local weather. |

The Affect of Tanzanian Investments on kenya’s Financial Panorama

The surge of Tanzanian investments into Kenya has heralded a brand new bankruptcy within the East African financial narrative, showcasing a powerful interdependence between the 2 countries. Those investments basically waft into strategic sectors corresponding to agriculture, tourism, and infrastructure, which can be essential for Kenya’s financial expansion and activity advent. As Tanzanian companies identify a foothold in Kenya,they carry no longer most effective capital but additionally experience,facilitating era switch and adorning native capability. This collaborative spirit is poised to toughen regional competitiveness and financial resilience around the East African Group.

Key spaces witnessing notable influxes of Tanzanian capital come with:

- Agricultural Construction: Funding in agro-processing companies that improve meals safety and export alternatives.

- Tourism Ventures: Joint ventures in hospitality are set to diversify choices, attracting vacationers to each nations.

- Infrastructure Initiatives: Financing and development partnerships geared toward making improvements to transportation networks and get right of entry to to markets.

| Sector | Funding Alternatives | Financial Affect |

|---|---|---|

| Agriculture | Agro-based industries, Export processing | Spice up in native employment and export revenues |

| Tourism | Lodge tendencies, eco-tourism tasks | Build up in global guests and native industry revenues |

| Infrastructure | Street and rail development, Renewable power | Enhanced connectivity and effort sustainability |

Demanding situations and Alternatives for Bilateral Industry Members of the family between Kenya and Tanzania

Each Kenya and Tanzania proportion a wealthy historical past as vital avid gamers in East Africa’s financial panorama, but they face distinctive demanding situations that have an effect on the fluidity in their bilateral industry family members. Problems corresponding to shipping infrastructure, industry boundaries, and differing regulatory frameworks can obstruct seamless trade between the 2 countries. the loss of coordination in customized procedures continuously sufficient ends up in delays in industry, negatively impacting the total financial dating. Moreover, native industries occasionally understand festival from neighbor nations, leading to protectionist sentiment that may additional complicate industry dynamics.

Despite the fact that, navigating those hurdles additionally uncovers really extensive alternatives for expansion and collaboration that each countries can leverage. By way of bettering infrastructure building thru joint funding projects, each nations can toughen industry logistics. Agreements geared toward streamlining customs rules have the prospective to foster smoother transactional processes. Additionally, there is a chance to capitalize on complementary financial strengths; for instance, Kenya’s developments in era and Tanzania’s huge agricultural assets can create symbiotic industry relationships. Strengthening bilateral dialogues can pave the way in which for projects that receive advantages each economies, atmosphere a robust basis for long term investments.

| Key Demanding situations | Doable Alternatives |

|---|---|

| Shipping Infrastructure | Joint Funding in infrastructure Initiatives |

| Industry Obstacles | Streamlining Customs Procedures |

| Differing Regulatory Frameworks | harmonization of Industry Rules |

| Protectionist Sentiments | Collaboration on Financial Strengths |

Strategic Suggestions to improve FDI Go with the flow within the Area

to strengthen international direct funding (FDI) in Kenya and solidify its place inside the East African area, a number of strategic interventions may also be applied. Initially, bettering regulatory frameworks to make sure well timed approvals and simplified processes for traders can foster a extra welcoming surroundings. Setting up a devoted process pressure to deal with bureaucratic bottlenecks is very important. Moreover, selling public-private partnerships to pressure infrastructure building can considerably toughen the good looks of funding alternatives. Those partnerships will have to focal point on key sectors corresponding to transportation,power,and era,aligning with the area’s expansion attainable.

Moreover, it is important to toughen regional industry agreements that may catalyze funding flows. Starting up boards to glue attainable traders from Tanzania and different East African countries can improve cooperation and mutual advantages.Supporting key sectors like agriculture, production, and renewable power thru adapted incentives can draw in extra international traders. As indicated within the following desk, those sectors have proven really extensive attainable for expansion and may also be prioritized in funding methods:

| Sector | Doable Expansion (%) | Funding Beauty |

|---|---|---|

| Agriculture | 6.5 | Top |

| Production | 8.0 | very Top |

| Renewable Power | 10.0 | Important |

The Long run of East African Financial Integration Thru Tanzanian Investments

The upward push of Tanzanian investments in Kenya is a vital building that underscores the evolving dynamics of financial integration inside of East Africa.As Tanzania emerges because the main supply of International Direct funding (FDI) in Kenya, the results for broader regional collaboration are transparent. This development illustrates no longer just a sturdy bond between the 2 countries but additionally highlights the opportunity of enhanced financial actions around the East African Group (EAC). Key sectors experiencing greater investments come with:

- Agriculture: Enhanced industry and agro-based ventures.

- Infrastructure: Joint ventures in shipping and interplay.

- Production: New factories aiming to spice up native economies.

- Tourism: Construction of sights that draw guests from in another country.

As Tanzanian corporations amplify into Kenya, the industrial panorama of the area is reworking. The inflow of investments no longer most effective creates jobs but additionally fosters cross-border cooperation and alternate of experience,paving the way in which for enhanced innovation. From joint infrastructure projects to collaborative efforts in power manufacturing, the partnerships shaped thru those investments exemplify a strategic manner against reaching a extra interconnected marketplace. The next desk illustrates sectors with vital Tanzanian funding in Kenya:

| Sector | Funding price (USD) | Key avid gamers |

|---|---|---|

| Agriculture | 150 million | Tanzanian Agro Ventures |

| Infrastructure | 200 million | Tanzania Development Ltd. |

| Power | 120 million | Tanzanian Energy Answers |

| Tourism | 80 million | East African Safari crew |

In Abstract

Tanzania’s emergence because the main supply of International Direct Funding (FDI) into Kenya underscores the evolving financial dynamics inside of East Africa. This development no longer most effective highlights the strengthening ties between the 2 neighboring countries but additionally displays a broader regional shift against greater intra-African funding. As each nations navigate financial restoration within the wake of worldwide demanding situations, fostering cross-border investments may well be key to maintaining expansion and adorning competitiveness within the area. Policymakers in each Tanzania and Kenya are inspired to proceed making a conducive surroundings that promotes additional collaboration, making sure that those funding flows give a contribution to the long-term development goals of East Africa. Because the area positions itself at the world financial map, such partnerships can be pivotal in riding innovation, activity advent, and total financial prosperity.

Source link : https://afric.news/2025/04/02/tanzania-leads-as-top-source-of-fdi-into-kenya-in-east-africa-the-eastafrican/

Creator : Noah Rodriguez

Put up date : 2025-04-02 05:23:00

Copyright for syndicated content material belongs to the connected Source.