Implications of the New Import Tax in Burkina Faso, Mali, and Niger

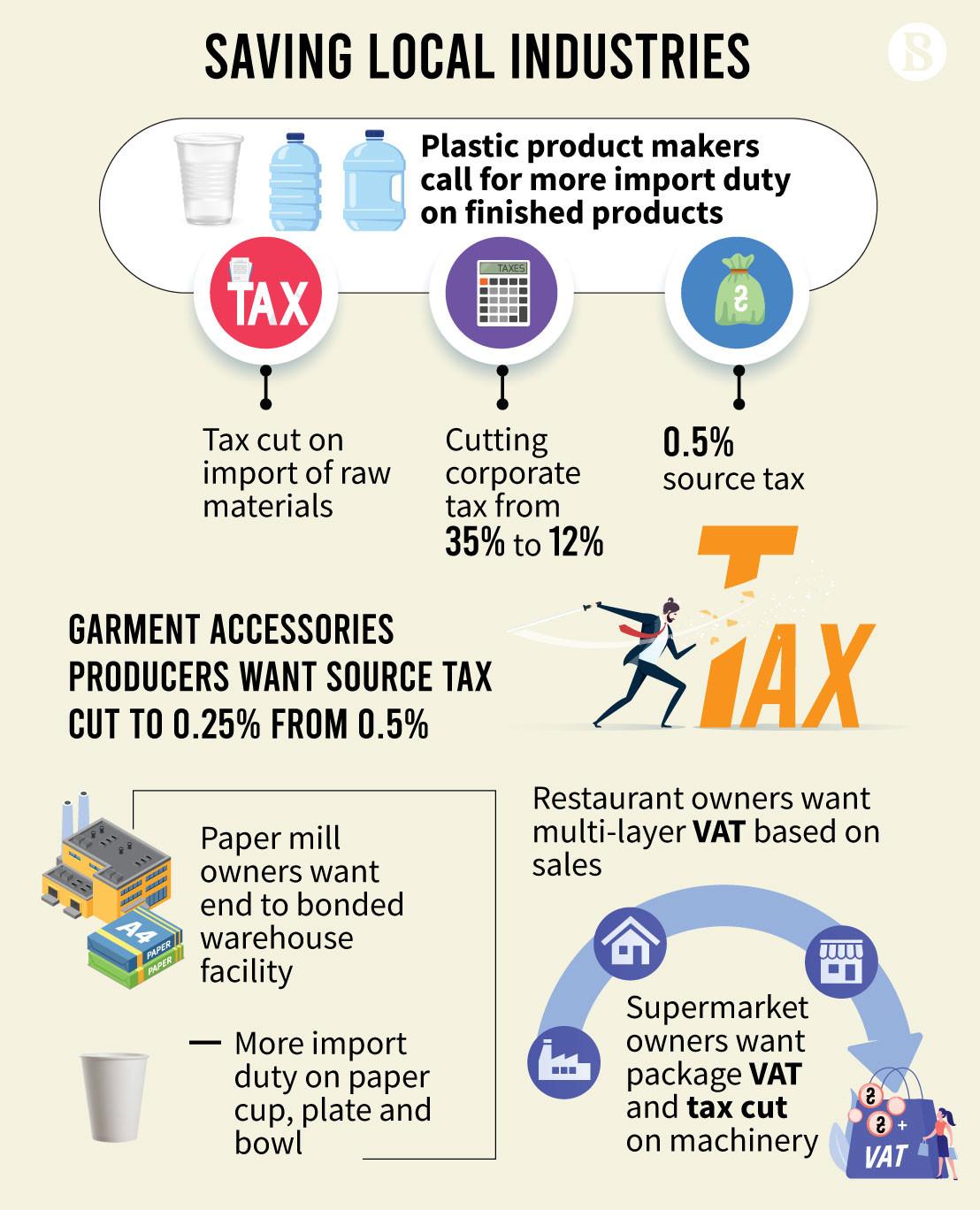

The introduction of a 0.5% import tax in Burkina Faso, Mali, and Niger is a strategic move aimed at bolstering funding for Agricultural Extension Services (AES) activities. This incremental tax is expected to generate significant revenue that can be redirected towards enhancing agricultural practices, improving food security, and supporting local farmers. The tax will likely impact the pricing of imported goods, wich may lead to an increase in consumer costs; though, it seeks to establish a more sustainable agricultural framework within these nations. Stakeholders across various sectors are urged to prepare for shifts in market dynamics as the tax begins to take affect.

furthermore, the implications of this tax reach beyond immediate financial concerns. Increased funding for AES could lead to improved agricultural infrastructure, access to better tools, and enhanced training for farmers, thereby fostering innovation within the agricultural sector. Key outcomes might include:

- Enhanced crop yields thru the adoption of modern farming techniques.

- Strengthened local economies as farmers gain more resources and knowledge.

- Boosted exports due to improved quality and productivity in agriculture.

while this tax may pose challenges initially, its long-term benefits could pave the way for agricultural advancement and economic resilience in the region.

Understanding the Rationale Behind the 0.5% Import Tax for AES Funding

the recent implementation of a 0.5% import tax across Burkina Faso, Mali, and Niger has sparked discussions about its impact and purpose. This levy is primarily aimed at generating sustainable funding for Agricultural Extension Services (AES), a crucial mechanism for enhancing agricultural productivity and ensuring food security in the region. By taxing imports, the governments intend to create a dedicated revenue stream that can be used to support agricultural education, training, and development programs. These initiatives aim to equip farmers with modern techniques and knowledge, ultimately boosting their yield and improving livelihoods.

Supporters of the tax argue that this modest levy can significantly enhance the capacity of AES to serve farmers more effectively. The funds raised will be allocated towards key areas such as:

- Training and Capacity Building: Developing skills and knowledge among local farmers.

- Infrastructure Development: Improving access to markets and resources.

- Research and Innovation: Promoting research that leads to sustainable agricultural practices.

This approach not only aims to increase agricultural output but also addresses challenges such as poverty and food insecurity. By prioritizing investment in agriculture, these countries are laying the groundwork for long-term economic growth and resilience in the face of evolving challenges.

Impact on Local Economies and Trade Dynamics in West Africa

The introduction of a 0.5% import tax by Burkina Faso, Mali, and Niger is poised to reshape local economies and the dynamics of trade within West Africa significantly. This tax, aimed at funding activities related to the African Economic Summit (AES), is expected to yield substantial revenue that can be reinvested into essential services and infrastructure. As these countries are strategically positioned within the regional trade network, this change could lead to enhanced economic resilience and increased investment in sectors such as agriculture, education, and health. The additional revenue stream may help stimulate local industries and reduce reliance on foreign goods, thereby encouraging domestic production.

Though, the new tax may also introduce complexities into existing trade relationships within the Economic Community of West African States (ECOWAS). Businesses that rely on imports for raw materials could face increased costs, which may hinder competitiveness both locally and regionally. Additionally, the following factors could influence the short-term and long-term impacts on trade dynamics:

- Increased Costs: Higher import costs may lead to inflationary pressure on consumer prices.

- Local Production Incentives: Domestic manufacturers may benefit from reduced competition.

- Cross-Border Trade Regulations: Changes may necessitate adjustments in customs procedures and trade agreements.

- Potential Smuggling Risks: There could be an increase in informal trade practices as businesses seek to evade taxes.

Potential Benefits for Agricultural Ecosystems and Sustainability Initiatives

the introduction of a 0.5% import tax in Burkina Faso, Mali, and Niger serves as a strategic financial mechanism designed to bolster agricultural ecosystem services (AES) and sustainability initiatives. This modest levy aims to channel funds towards innovative practices that enhance land health, promote biodiversity, and improve water resource management. With the revenue generated, the governments can invest in initiatives that support local farmers in adopting sustainable farming methods, such as:

- Crop rotation and polyculture to enhance soil fertility and reduce pest pressures.

- Agroforestry systems that integrate trees and shrubs into crop lands, providing multiple ecological benefits.

- Organic farming practices that minimize the reliance on synthetic fertilizers and pesticides.

Additionally, this funding mechanism presents an opportunity for regional collaboration, fostering partnerships between governments, NGOs, and agricultural stakeholders. By pooling resources for a common goal, countries can develop programs to educate farmers about sustainable practices, promote technology transfer, and establish community-based monitoring systems. A potential use of funds includes the establishment of training centers, as outlined in the table below, which indicates proposed allocations for specific initiatives:

| Initiative | Proposed Funding (%) |

|---|---|

| Training Centers | 40% |

| research & Development | 30% |

| biodiversity Projects | 20% |

| Monitoring & Evaluation | 10% |

Recommendations for Effective Allocation of Tax Revenues

To ensure that the newly introduced 0.5% import tax effectively supports activities in the Agricultural Extension Services (AES), it is crucial to implement a well-structured allocation strategy. Prioritization of funding should focus on areas that yield the highest impact, including:

- Training programs for farmers to enhance productivity and sustainability.

- Research initiatives that address specific local agricultural challenges.

- Infrastructure development to improve access to markets and resources.

- Community engagement to ensure that the needs and voices of local farmers are considered.

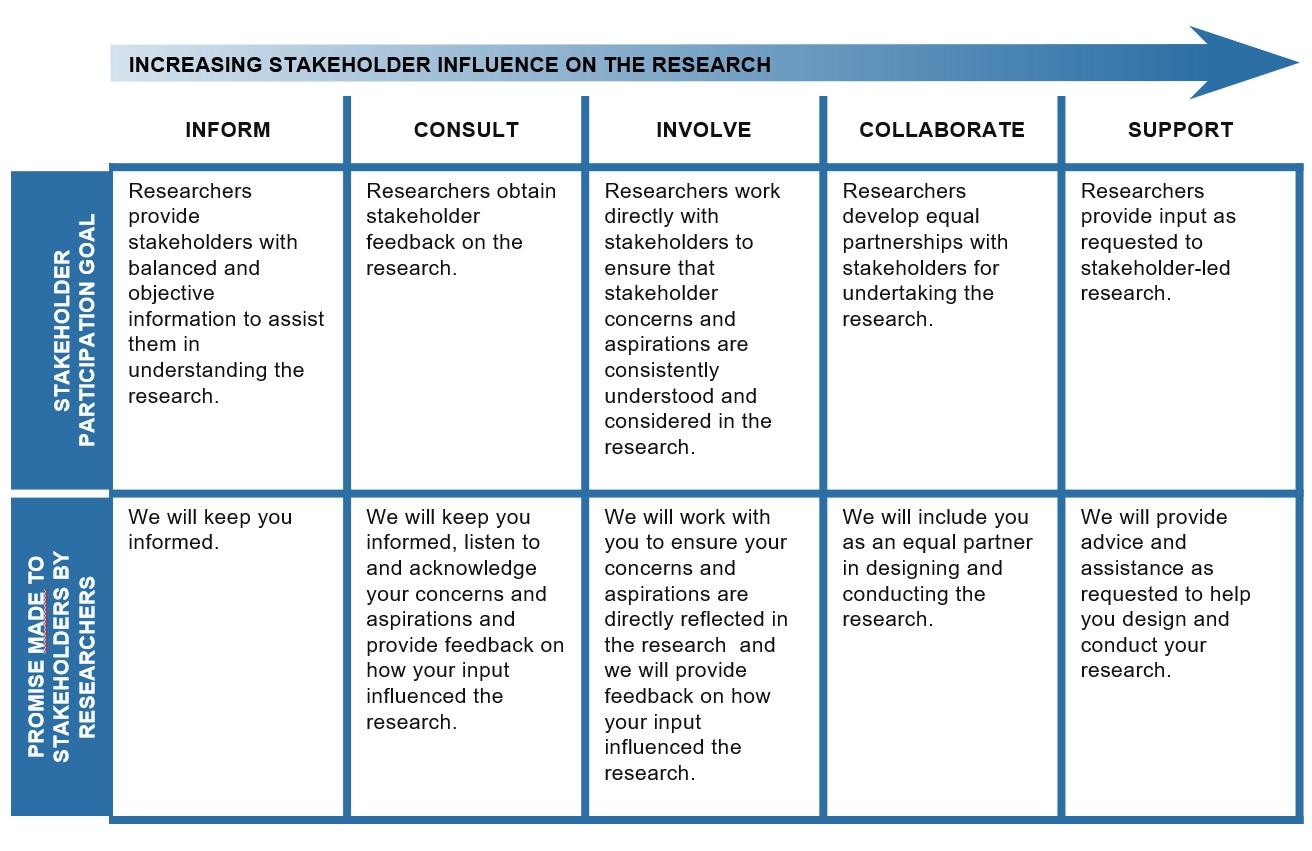

Furthermore, openness and accountability in the allocation process are essential to gain public trust and ensure efficient use of resources. Establishing a public reporting mechanism can facilitate community oversight. Suggested measures include:

- Regular audits of fund allocation and expenditure to highlight successes and areas for betterment.

- Feedback loops for stakeholders to express concerns and suggestions directly linked to AES outcomes.

- Collaboration with NGOs and local organizations to leverage their expertise and networks for greater impact.

Responses from Stakeholders and Regional Cooperation Opportunities

The introduction of a 0.5% import tax by Burkina Faso, Mali, and Niger has elicited a range of responses from stakeholders across various sectors.Economic experts emphasize that this measure, intended to bolster the financing of the Alliance for Sahel (AES) activities, could significantly enhance regional security and development. Business leaders, however, express concerns regarding the potential impact on trade costs and competitiveness in a region already grappling with economic challenges. The consensus among many stakeholders is that a clear allocation of these funds is crucial for maintaining trust and ensuring that investments contribute effectively to the AES objectives.

Moreover, this new tax could open doors to increased collaboration within the region, fostering cooperative initiatives among neighboring countries. Opportunities for regional cooperation include:

- joint infrastructure projects that improve trade routes

- Shared intelligence networks for enhanced security

- Collaborative training programs to strengthen local capacities

To facilitate these initiatives, a proposed framework for stakeholder engagement has been outlined:

| Engagement type | Description |

|---|---|

| Public-Private Partnerships | Collaboration between the government and private sector to fund AES projects. |

| Multi-Agency Task Forces | Creation of task forces including various government and NGO representatives. |

| Cross-Border Consultations | Regular meetings among stakeholders from the three nations to synchronize efforts. |

These collaborative efforts, if properly implemented, could pave the way for a more unified approach to tackling the pressing issues facing the Sahel region, generating sustainable economic growth and enhanced security for all member states.

The Conclusion

the introduction of a 0.5% import tax by Burkina faso, Mali, and Niger marks a significant step in funding the crucial activities of the Alliance for the Sahel (AES). This collaborative initiative not only seeks to address pressing security challenges in the region but also aims to enhance economic stability through improved infrastructure and social services. While the efficacy of this measure will depend on transparent implementation and the cooperation of all stakeholders, it highlights a proactive approach to regional challenges. As these West African nations navigate the complexities of governance and development, the success of the AES will be closely monitored, serving as a litmus test for future collaborative efforts in the region. The coming months will be pivotal in determining whether this financial initiative translates into tangible improvements in security and quality of life for the citizens of Burkina Faso, Mali, and Niger.

Source link : https://afric.news/2025/04/05/burkina-faso-mali-niger-introduce-0-5-import-tax-to-fund-aes-activities-the-north-africa-post/

Author : Victoria Jones

Publish date : 2025-04-05 14:46:00

Copyright for syndicated content belongs to the linked Source.