fluctuating global oil prices. Because the island country grapples with its budgetary constraints and seeks to stabilize its financial system, the lengthen on this expected investment raises considerations in regards to the doable repercussions on public products and services and general financial enlargement. This newsletter delves into the consequences of the IMF’s resolution, inspecting the wider context of madagascar’s financial demanding situations and the pressing want for coverage reforms within the face of emerging gas prices.

Madagascar Faces IMF Mortgage Setback Amidst petrol Worth Discrepancies

Madagascar’s govt is these days grappling with the results of no longer adjusting petrol costs,a pivotal issue that has led the World Financial Fund (IMF) to lengthen a the most important $103 million mortgage to the country. The IMF’s resolution underscores the group’s stringent necessities for monetary beef up, particularly in gentle of monetary reforms which might be designed to stabilize Madagascar’s fiscal scenario. Stakeholders in Antananarivo are involved that falling in need of those conditions no longer simplest jeopardizes quick monetary help however may additionally have an effect on long term world investments and assist.

A number of elements give a contribution to this example, together with:

- Inflation Charges: Emerging inflation has considerably impacted oil costs globally.

- Govt Stance: A reluctance to extend petrol costs amidst public outcry has stalled necesary reforms.

- IMF Expectancies: The IMF expects member international locations to align gas costs with world marketplace charges for transparency and monetary legal responsibility.

In gentle of those trends, the Malagasy financial system faces mounting power, with doable repercussions for public products and services and infrastructure. The federal government is at a crossroads, as a failure to agree to IMF suggestions coudl result in additional financial isolation.

| Key Issues | Affects |

|---|---|

| IMF Mortgage Lengthen | Get entry to to finances for enlargement tasks rejected |

| public Outrage | Doable civil unrest and protests |

| World Economical Requirements | Greater scrutiny from monetary establishments |

Examining the Implications of not on time Investment on Madagascar’s Financial system

The lengthen within the World Financial Fund (IMF) mortgage to Madagascar, amounting to $103 million, carries vital ramifications for the country’s financial panorama. This investment was once contingent upon the federal government’s dedication to essential petrol value changes, which displays broader problems with fiscal control and financial resilience. With out this capital inflow, Madagascar faces doable repercussions corresponding to:

- Greater Vulnerability: The absence of overseas finances would possibly obstruct the federal government’s talent to beef up crucial products and services and infrastructure tasks.

- Inflation and Value of Residing: Extended delays in gas value changes may just exacerbate inflation, affecting the common citizen’s buying energy.

- Investor Self belief: Such delays would possibly hose down investor sentiment, resulting in wary monetary commitments to the rustic.

Moreover, the location raises questions in regards to the govt’s capability to navigate financial reforms, which can be necessary for enduring enlargement. The present gridlock may just stall efforts to enforce essential adjustments in fiscal coverage and financial technique. Observers would possibly be aware the next affects:

| affect House | Doable Results |

|---|---|

| Public Services and products | Lowered investment for training and healthcare. |

| Overseas Assist | Pressure on partnerships with world donors. |

| Social Balance | Greater chance of civil unrest because of financial misery. |

The Significance of Gasoline Worth changes in Securing World Loans

Gasoline value changes play a the most important position within the financial balance of countries, serving as a barometer for fiscal coverage and world monetary commitments. For Madagascar, the failure to enforce those changes has resulted within the not on time $103 million mortgage from the World Financial Fund (IMF), underscoring the possible penalties of neglecting such necessary financial methods. Pricing gas accurately no longer simplest impacts the federal government’s earnings but in addition influences inflation charges and the whole value of dwelling, which can result in social unrest if no longer controlled correctly.

The IMF steadily sufficient ties monetary help to express reforms aimed toward making improvements to financial resilience. In Madagascar’s case,elevating gas costs is noticed as a essential step to strengthen budgetary self-discipline and scale back reliance on exterior borrowing.Key issues that illustrate the importance of those changes come with:

- Earnings Era: Greater gas costs can strengthen govt revenues, taking into account extra vital investments in infrastructure and public products and services.

- Marketplace Competitiveness: aligning native gas costs with international requirements is helping to attract foreign investment via making a extra strong financial setting.

- Inflation Regulate: Correct changes can save you unchecked inflation, which erodes buying energy and affects citizen welfare.

Methods for Madagascar to Cope with IMF Considerations and Stabilize Financial system

In gentle of the new delays in securing a the most important $103 million mortgage from the World Financial Fund (IMF), Madagascar should undertake a multifaceted method to reassure each the worldwide monetary neighborhood and its voters. Addressing IMF considerations basically hinges at the govt’s willingness to enforce essential financial reforms, particularly within the power sector. Key methods may just come with:

- Adjusting Gasoline Pricing: Steadily updating petrol costs to mirror international oil value fluctuations, making sure that subsidies don’t expend govt finances.

- Bettering Fiscal Accountability: Imposing stricter budgetary controls to reduce waste and building up transparency in public spending.

- Diversification of Power Resources: Making an investment in renewable power to scale back dependence on petroleum imports and offer protection to the financial system from risky oil costs.

- Strengthening Conversation with the IMF: Organising steady communique channels with IMF representatives to obtain well timed comments on proposed reforms.

Moreover, Madagascar may just have the benefit of fostering a extra tough partnership with home and world stakeholders to create a strong financial setting. This can also be accomplished thru:

- public-Non-public Partnerships: Encouraging investments in infrastructure that may end up in task introduction and financial enlargement.

- Selling Native Manufacturing: Supporting native industries to minimize the reliance on imports and spice up the nationwide financial system.

- Social Protection Nets: introducing techniques to lend a hand susceptible populations suffering from financial changes, making sure that reforms don’t result in popular hardship.

Suggestions for Long run Financial Reforms and Fiscal Accountability

To navigate the present financial demanding situations and foster sustainable enlargement, madagascar will have to prioritize a sequence of reforms. Those measures can streamline governance and strengthen fiscal duty. Key suggestions come with:

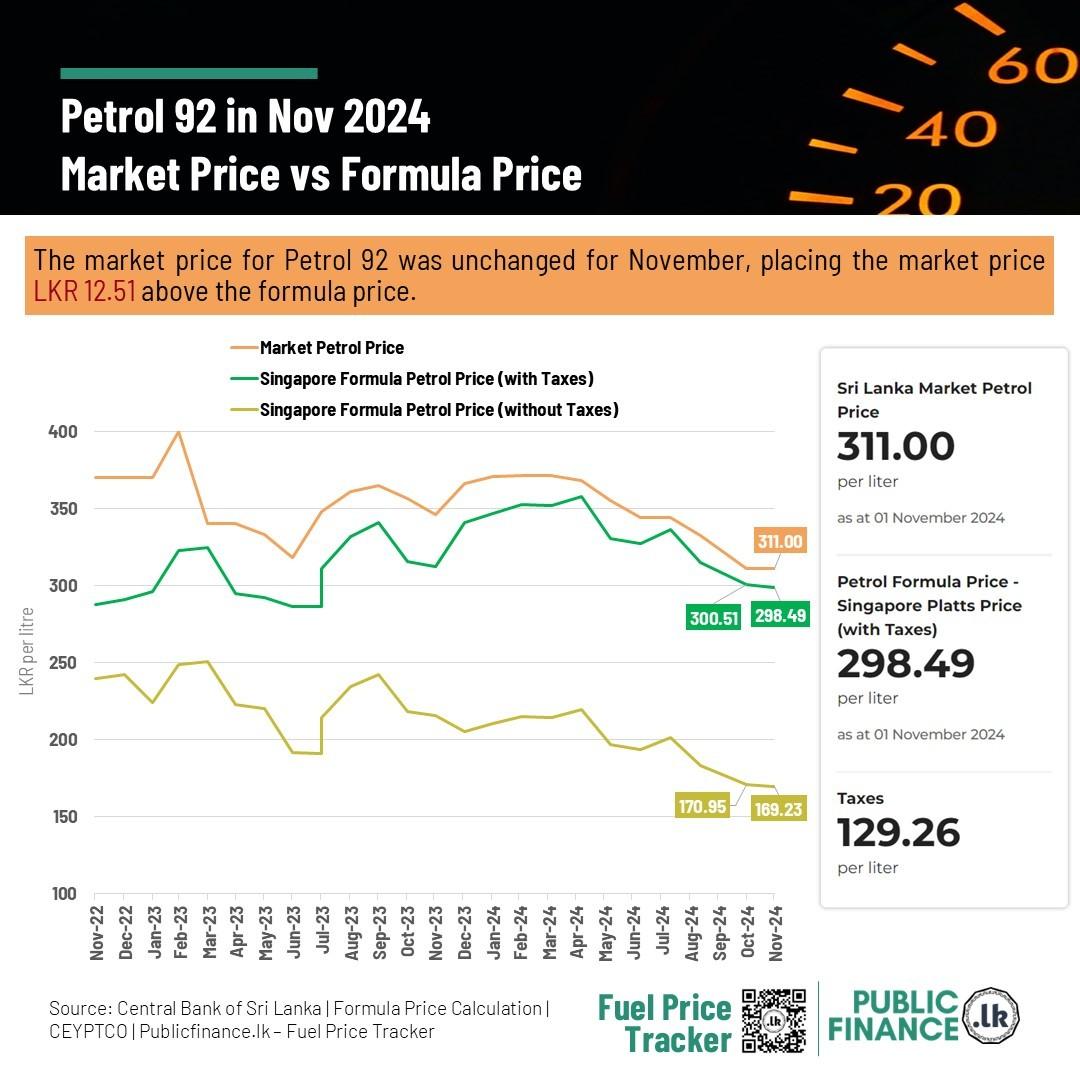

- Imposing a clear petrol pricing mechanism that displays world marketplace traits.

- Reforming taxation insurance policies to increase the tax base whilst making sure equity for low-income families.

- Strengthening public monetary control methods to maximise useful resource allocation and reduce waste.

Additionally, it’ll be crucial for the federal government to foster collaboration with world monetary establishments. Through doing so, Madagascar can get entry to experience and assets that bolster financial resilience. Key methods may just contain:

- Organising benchmarks for fiscal self-discipline and financial efficiency.

- Growing incentives for overseas direct funding to stimulate task introduction and innovation.

- Attractive with native communities to make sure that reforms align with grassroots wishes and priorities.

The Position of Transparency in Strengthening Madagascar’s World Members of the family

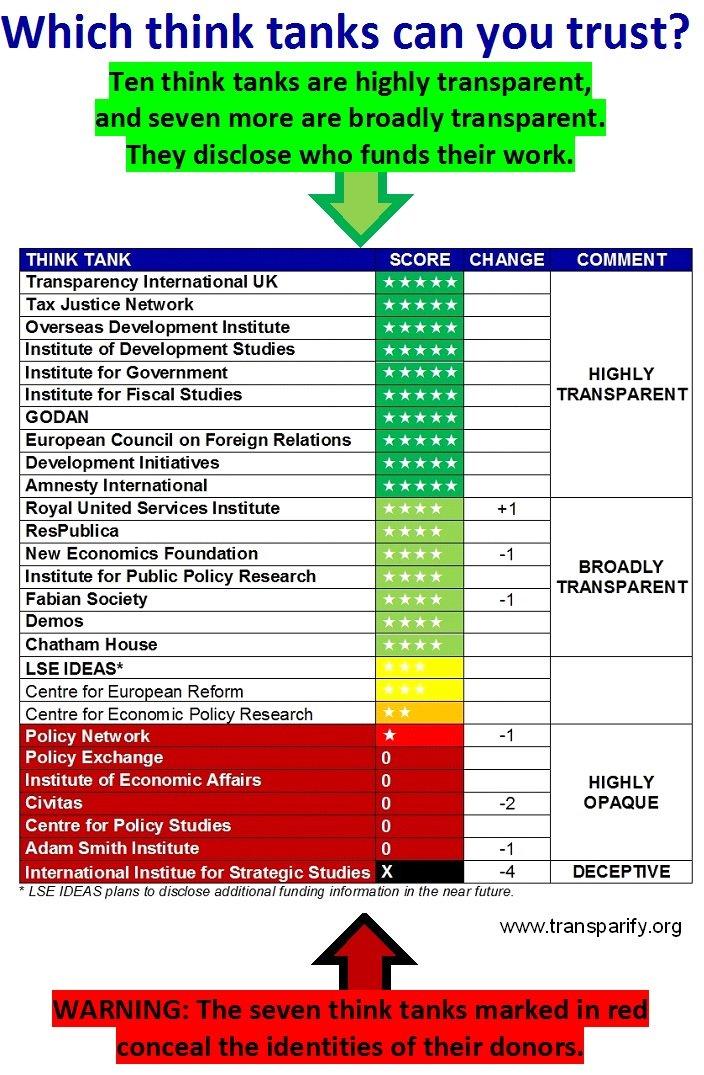

Within the complicated tapestry of world family members,transparency serves as a cornerstone for consider and credibility.In Madagascar’s fresh dealings with the World Financial Fund (IMF), the failure to regulate petrol costs has no longer simplest hindered get entry to to crucial monetary help but in addition raised questions in regards to the govt’s transparency and monetary control. Prioritizing open communique relating to financial insurance policies and selections is necessary; it demonstrates a dedication to duty, which will considerably affect diplomatic family members and world partnerships. Madagascar, to meet its responsibilities and bolster self belief amongst overseas stakeholders, should embody transparency as a basic side of governance.

Moreover, the consequences of transparency prolong past quick monetary get entry to. Through fostering a transparent and open discussion with world our bodies and overseas buyers, Madagascar can beef up its credibility at the international degree. This may end up in enhanced cooperation and alternatives, paving the best way for tough financial building. Believe the next advantages of transparency in world family members:

- Progressed Investor Self belief: Open practices draw in overseas direct funding.

- Reinforced Partnerships: Believe facilitates smoother negotiations with world organizations.

- Enhanced Governance: Transparency promotes higher decision-making and duty.

Ultimate Ideas

the new resolution via the World Financial Fund (IMF) to delay the disbursement of an important $103 million mortgage to Madagascar highlights the crucial implications of fiscal control within the nation. The lengthen, attributed to the federal government’s failure to enforce essential changes to petrol costs, underscores the interconnectedness of monetary coverage, world help, and public duty. As madagascar navigates those monetary demanding situations, the results won’t simplest affect its financial balance but in addition the wellbeing of its voters amidst emerging gas prices. The placement requires a reassessment of governance methods and a renewed dedication to compliance with world monetary agreements with a purpose to foster sustainable building and pave the best way for long term the help of international monetary establishments. In the long run, how Madagascar addresses those urgent problems will decide its financial trajectory and dating with the IMF transferring ahead.

Source link : https://afric.news/2025/02/24/madagascar-imf-delays-103m-loan-to-antananarivo-for-failing-to-make-petrol-price-adjustments-africa-intelligence/

Creator : Ethan Riley

Post date : 2025-02-24 01:44:00

Copyright for syndicated content material belongs to the connected Source.