broader socio-economic landscape.

Ethiopia‚Äôs‚Ā§ Landmark ‚Ā£Transfer Towards Monetary Modernization

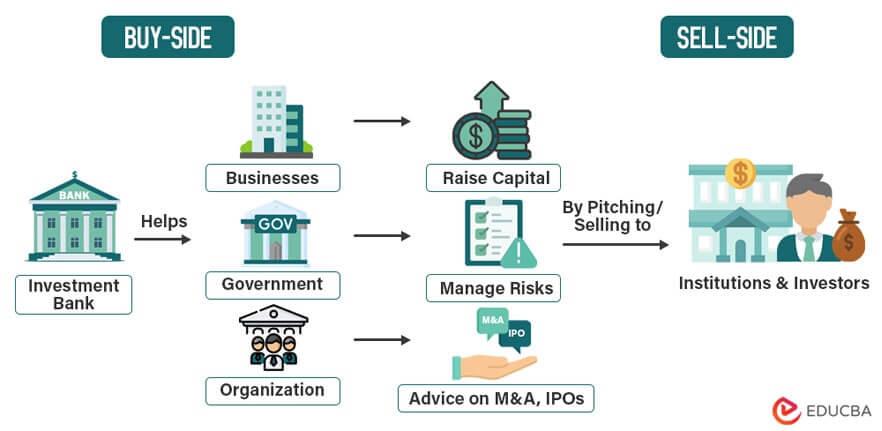

Ethiopia has taken a vital step against bettering its monetary‚Ā£ panorama by means of issuing its first funding banking licenses, ‚Äčmarking a pivotal second‚Ā£ within the country‚Äôs financial ‚ĀĘadventure. This transfer is anticipated to catalyze the expansion of a powerful non-public funding banking sector, ‚Äčthereby attracting each native and world ‚Äćbuyers. With those licenses, establishments are empowered to have interaction in actions similar to underwriting securities, providing advisory products and services for‚Äč mergers and acquisitions, and managing funding price range. The Ethiopian ‚ÄĆgovt‚Äôs dedication to ‚Äćmonetary‚Äč modernization is clear in its efforts to ‚Ā§create ‚ÄĆa extra conducive setting‚Äč for investments.

The ‚Ā£creation ‚Ā£of funding banking licenses is expected to result in a number of transformative results for ‚Ā§the Ethiopian economic system, together with:

- Higher Capital‚ÄĆ go with the flow: ‚ĀĘEnhanced‚ÄĆ get admission to to capital markets will allow companies to lift ‚Ā§price range extra successfully, selling‚ĀĘ entrepreneurship.

- Monetary Experience: Setting up a robust funding banking sector will foster monetary ‚Ā§literacy and experience throughout the nation.

- Various Monetary‚Äč Merchandise: ‚Äč Buyers will ‚ĀĘhave the benefit of a‚Ā§ wider vary‚Ā§ of‚Ā£ monetary merchandise adapted‚Ā£ to their wishes.

As Ethiopia embarks in this ‚ĀĘmodernization adventure,‚Ā§ stakeholders from‚Äć quite a lot of sectors‚ÄĆ are inspired to have interaction actively, making sure that‚ÄĆ the advantages‚Äč of funding banking‚Ā§ ripple all over the economic system.

Figuring out the ‚ĀĘAffect of Funding Banking on Ethiopia‚Äôs ‚Ā£Financial system

The issuance of the primary funding banking ‚Ā§licenses in Ethiopia ‚ĀĘmarks a vital milestone‚Äč within the‚Ā§ country‚Äôs financial trajectory. Via growing ‚Äča structured framework for funding banking,the Ethiopian govt is opening avenues for enhanced‚Ā£ capital mobilization,which is very important for infrastructural building ‚Ā§and industrialization.This transfer‚Ā£ is about to draw each home and overseas investments,‚ÄĆ resulting in an inflow of price range that may stimulate sectors similar to‚Ā£ agriculture, production, and products and services.Funding banks can act as‚ÄĆ facilitators for ‚Äćmergers and acquisitions, bond issuance, and‚Ā§ long-term investment answers, bettering‚Äč the total monetary ‚ĀĘstructure ‚ÄĆof the rustic.

Additionally, ‚Äčthe established order of funding ‚Ā£banking will most probably have a ripple impact on task advent and abilities building. The trade ‚Ā§will necessitate a‚ĀĘ personnel provided with specialised ‚Ā£monetary ‚Äčexperience,‚Äć fostering instructional ‚ĀĘprojects and ‚Ā£coaching ‚Ā£systems to supply professional execs. As funding banks take root, they may be able to function catalysts for fostering entrepreneurial projects amongst native companies, offering‚ÄĆ very important advisory products and services and leading edge monetary ‚ĀĘmerchandise that beef up ‚ÄĆstartups and present companies. this interconnected enlargement‚Äč will result in a extra resilient economic system in a position to resisting exterior shocks and adorning the ‚ÄĆlivelihoods of ‚ÄĆvoters.

Key Avid gamers and ‚ÄćAlternatives within the Rising Funding Banking Sector

The new issuance of‚Äč funding banking licenses in ethiopia‚Ā£ marks‚Äč a transformative‚Ā£ second for the country‚Äôs monetary panorama, paving the ‚ĀĘmethod‚Ā£ for each ‚Ā£native and ‚ÄĆworld companies‚Ā£ to ‚Ā§have interaction in a‚Äč number of monetary actions.Key avid gamers on this burgeoning sector are rising ‚Ā§from‚Ā§ quite a lot of backgrounds, together with native banks taking a look to diversify their products and services,‚Äč overseas funding establishments in quest of untapped alternatives, ‚ĀĘand fintech innovators aiming to combine fashionable applied sciences into‚Ā£ conventional banking practices. ‚ÄćThose entities are set to reshape the funding local weather,‚ÄĆ toughen capital markets, and facilitate the mobilization of home and‚Ā£ overseas‚ÄĆ capital.

Doable alternatives ‚ÄĆabound for stakeholders ‚ĀĘon this newly ‚Ā£minted funding banking sector. Noteworthy potentialities come with:

- infrastructure Financing: Funding banks can‚Ā£ play a an important function in investment large-scale‚Ā£ infrastructure initiatives.

- Advisory Products and services: providing experience in mergers, acquisitions, and ‚ÄĆpublic choices for native enterprises in quest of enlargement.

- Funding Control: ‚Ā£ Growing wealth control merchandise adapted for the emerging center‚Äč elegance.

- marketplace Building: Making a ‚Äćextra powerful capital marketplace through leading edge monetary tools.

| Key‚ÄĆ Avid gamers | Alternatives |

|---|---|

| Native ‚ÄćBanks | Infrastructure Financing |

| world Banks | M&A‚ÄĆ Advisory Products and services |

| Fintech Corporations | Funding Control |

| Non-public Fairness Companies | Marketplace ‚ÄčBuilding |

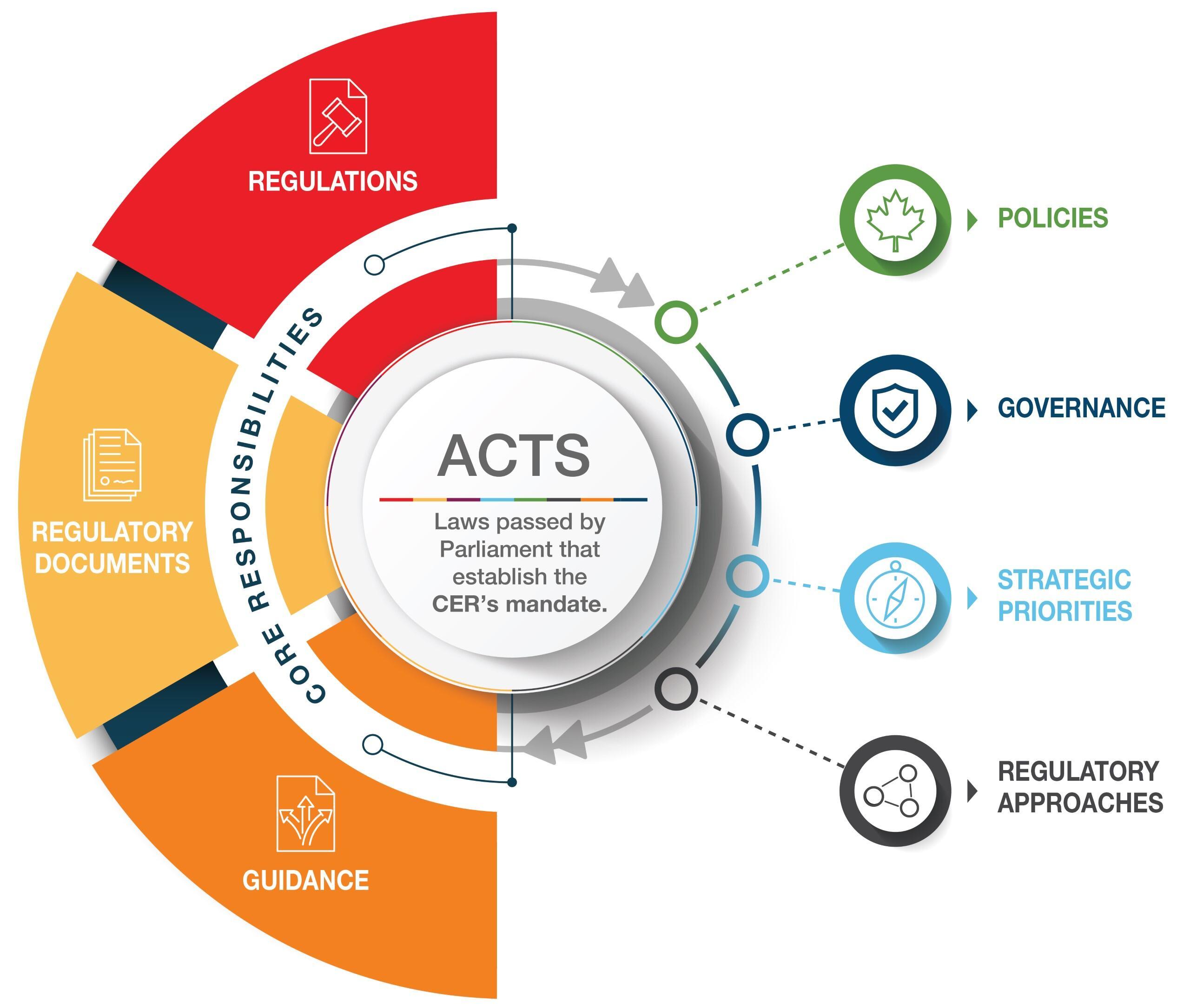

Regulatory Framework: Making sure Compliance and Expansion in Funding Banking

The creation of ‚Äčfunding banking licenses in ethiopia marks a ‚ĀĘpivotal ‚Äčshift within the regulatory panorama, surroundings the level for enhanced compliance mechanisms along trade enlargement.‚Äć With regulatory government now overseeing this rising sector, there’s a powerful‚Äč framework that ‚Äćgoals to foster balance and transparency. ‚Ā£The federal government‚Äôs‚Äč means is‚ĀĘ multifaceted, together with:

- Licensing Necessities: Strict standards for doable‚Ā§ funding banks to verify monetary soundness and moral‚ĀĘ operations.

- Shopper Coverage: Tips to safeguard ‚ÄĆthe‚ÄĆ pursuits of buyers‚Ā§ and ‚Äčshoppers throughout the banking‚Ā£ gadget.

- Compliance Tracking: common exams by means of regulatory our bodies to verify adherence to ‚Ā£monetary‚Äć laws.

This regulatory framework is anticipated not to best‚Ā§ inspire native buyers but in addition draw in ‚Ā§overseas capital, as ‚ÄĆworld buyers incessantly prioritize areas with transparent governance and risk ‚ÄĆmanagement practices. Via setting up clear evaluative ‚Äćstandards,Ethiopia is shifting against a extra predictable funding ‚Äćsetting,which is an important for sustainable financial enlargement. Key‚Äč parts ‚ĀĘof‚ÄĆ this technique‚Äč come with:

| Key Parts | Affect |

|---|---|

| Chance Evaluate ‚Ā£Protocols | Enhanced‚Ā£ due diligence on funding alternatives. |

| Transparency Projects | Higher investor ‚ĀĘself assurance thru transparent‚Ā§ reporting ‚Ā£and duty. |

| Steady Training | Common coaching for monetary practitioners on compliance and ‚ÄĆethics. |

Subsequent Steps for ‚Ā§Buyers: Making the Maximum of ethiopia‚Äôs‚Ā£ New Panorama

As Ethiopia embarks on a brand new bankruptcy‚Äć with the issuance of ‚Ā§its first funding banking ‚Äćlicenses, buyers ‚Äćare offered with an array of‚Ā£ alternatives on this burgeoning marketplace. To successfully ‚Äčnavigate this evolving panorama, ‚Ā§it‚Äôs an important for stakeholders to perceive the regulatory framework being ‚Äčestablished. Attractive with‚Ā£ native monetary government‚ĀĘ and taking part in trade ‚Ā£seminars can give‚ÄĆ insights into compliance ‚Äčnecessities and operational requirements,paving the‚ĀĘ method for strategic investments.

As well as, ‚Ā£buyers shoudl center of attention on construction partnerships with native companies to toughen marketplace‚ÄĆ penetration and ‚Äčleverage native‚Äć experience.Imagine ‚ÄĆthe next methods ‚ĀĘto‚ÄĆ optimize funding results:

- Habits ‚ÄĆthorough marketplace analysis to ‚Äčdetermine sectors with ‚Ā£top enlargement doable.

- Collaborate with Ethiopian companies to verify alignment ‚Äčwith cultural ‚Äćand‚Äč operational practices.

- Keep‚Ā§ knowledgeable ‚Ā£on ‚Äčmacroeconomic tendencies and insurance policies that can affect funding local weather.

Additionally, buyers ‚ÄĆmight in finding price in exploring‚ĀĘ the next sectors the place ‚Ā£call for is projected to ‚Ā§develop:

| Sector | Anticipated Expansion ‚Ā£Affect |

|---|---|

| Agribusiness | top ‚Äď Expanding call for for exports ‚Ā§and meals ‚Äčsafety projects. |

| Renewable ‚ÄĆPower | Medium ‚Äď Executive projects selling sustainable power resources. |

| Telecommunications | Prime ‚Äď Liberalization of the sphere opens new ‚Ā§provider alternatives. |

Doable Demanding situations ‚ÄčGoing through Ethiopia‚Äôs Funding banking Business

The emergence of Ethiopia‚Äôs funding banking sector is a vital step against financial modernization, but it faces ‚Ā£a number of demanding situations that ‚ÄĆmay just obstruct its enlargement and‚Äć effectiveness. Regulatory ‚Ā§complexities shall be a number one worry; setting up a powerful felony framework that fosters transparency and ‚ĀĘinvestor self assurance is‚Äč an important. The loss of a complete regulatory ‚ĀĘsetting might deter each native and world buyers, leading to a limited go with the flow‚Äć of capital. ‚Ā§Moreover, the want for experienced execs inside‚ÄĆ the trade gifts a hurdle. Because the marketplace develops, there shall be a urgent call for for execs who’re well-versed in ‚Äćfunding ‚Ā£banking‚Ā£ ideas, monetary research, ‚ĀĘand chance‚Äč control.

Moreover,‚ĀĘ marketplace‚Ā§ volatility stays an underlying risk, specifically for a country present process vital financial transitions. Buyers‚ÄĆ would possibly probably be fearful‚Ā§ about ‚Äćmaking an investment in a marketplace characterised by means of unpredictable ‚ÄĆfinancial prerequisites and political dynamics. Infrastructure demanding situations additionally pose vital boundaries; deficiencies in technological frameworks and fiscal programs might restrict operational efficiencies for‚ÄĆ newly ‚Ā§approved companies.To navigate those stumbling blocks effectively, the funding banking trade should adapt and innovate frequently, cultivating a panorama that balances‚Äć chance with‚ĀĘ alternatives for sustainable enlargement.

In‚Ā£ Retrospect

Ethiopia‚Äôs groundbreaking resolution to factor ‚Äčits first funding banking licenses marks a vital milestone within the ‚ÄĆcountry‚Äôs‚ÄĆ financial evolution. This ‚Ā£strategic transfer no longer best opens the door for brand new monetary products and services inside ‚Ā§the rustic‚Ā§ but in addition alerts a broader dedication to modernize and diversify Ethiopia‚Äôs monetary panorama. Because the country integrates ‚Äčextra subtle banking practices,it’s poised to toughen its beauty to each home and world‚ÄĆ buyers,in all probability ‚Ā£riding financial enlargement and innovation. With the monetary sector poised for transformation, stakeholders shall be keenly looking at how‚ĀĘ those trends spread and affect Ethiopia‚Äôs aspirations ‚Ā§for‚Äč sustainable building and enhanced ‚Äćinternational financial participation.

Source link : https://afric.news/2025/04/03/ethiopia-issues-first-investment-banking-licenses-reuters/

Writer : Ethan Riley

Submit date : 2025-04-03 12:15:00

Copyright for syndicated content material belongs to the connected Source.