Kuwait Finance Area Declares Strategic Enlargement into Egypt

Kuwait Finance area (KFH) has formally introduced its formidable plans to enlarge its operations into the Egyptian marketplace, marking an important milestone in its expansion technique. This enlargement targets to leverage Egypt’s booming financial system and more and more favorable regulatory setting for Islamic finance.By means of organising a presence within the area, KFH intends to cater to a much broader clientele, fostering monetary inclusivity whilst adhering to the foundations of Sharia-compliant banking.The verdict aligns with KFH’s dedication to reinforce its carrier choices and faucet into new trade alternatives.

the growth technique rests on a number of key projects, together with:

- Funding Diversification: KFH targets to introduce a variety of Sharia-compliant funding merchandise adapted to the wishes of the Egyptian marketplace.

- Virtual Innovation: Emphasizing technological integration, KFH plans to reinforce its virtual banking products and services, making them out there to a broader target market.

- Partnership Construction: Strategic partnerships with local institutions will facilitate KFH’s marketplace access and expansion, making sure compliance with native laws.

Moreover,KFH’s access into Egypt is predicted to stimulate the native Islamic finance sector,offering much-needed festival and innovation. The Egyptian banking panorama, which is gradually leaning against Islamic finance, items KFH with a singular probability to put itself as a key participant. Stakeholders within the business are constructive in regards to the potentialities this enlargement provides, particularly on the subject of financial expansion and monetary steadiness throughout the area.

The Rising Call for for Islamic Finance in Egypt

The panorama of economic products and services in Egypt is present process an important trade, pushed essentially by means of the emerging acclaim for Islamic finance. Because the inhabitants more and more seeks monetary merchandise that conform to Sharia ideas, establishments are responding with an increasing array of choices. Particularly, Kuwait Finance Area has known this shift and is making strategic strikes to seize this burgeoning marketplace. Their access into the Egyptian monetary scene indicates a rising passion amongst regional gamers to determine a foothold in a marketplace with really extensive prospective for Islamic banking answers.

This burgeoning call for is fueled by means of a number of elements:

- Higher Consciousness: Manny Egyptians are changing into extra skilled about Islamic finance and its ideas, resulting in a better urge for food for monetary merchandise that align with their ideals.

- More youthful Demographics: A youthful population is using innovation and a desire for contemporary monetary answers, together with virtual banking products and services that adhere to Islamic ideas.

- Govt Tasks: Strengthen from the Egyptian executive within the type of regulatory frameworks has additional inspired the status quo and expansion of Islamic financial institutions.

Affect of kuwait Finance Area’s access at the Native Banking Sector

The access of Kuwait Finance Area (KFH) into the egyptian marketplace is poised to noticeably modify the dynamics of the native banking sector. With its sturdy popularity in Islamic finance,KFH’s enlargement is extremely prone to introduce heightened festival amongst current banks,in particular the ones aiming to reinforce their Sharia-compliant choices.The transfer might instructed native banks to innovate and fortify their products and services to retain shoppers, probably resulting in a broader vary of financing merchandise and enhanced potency around the sector.

Moreover, KFH’s presence can stimulate funding and financial expansion in Egypt, because the financial institution brings experience and new capital to the marketplace. This inflow can inspire different Islamic monetary establishments to faucet into the rising call for for Sharia-compliant banking answers. As a result, we may witness:

- Higher collaboration: native banks might search partnerships with KFH to leverage its revel in.

- Enhanced buyer consciousness: KFH’s advertising efforts can train shoppers on some great benefits of Islamic finance.

- Higher regulatory engagement: The Central Financial institution of egypt might reinforce its regulatory framework to house this burgeoning sector.

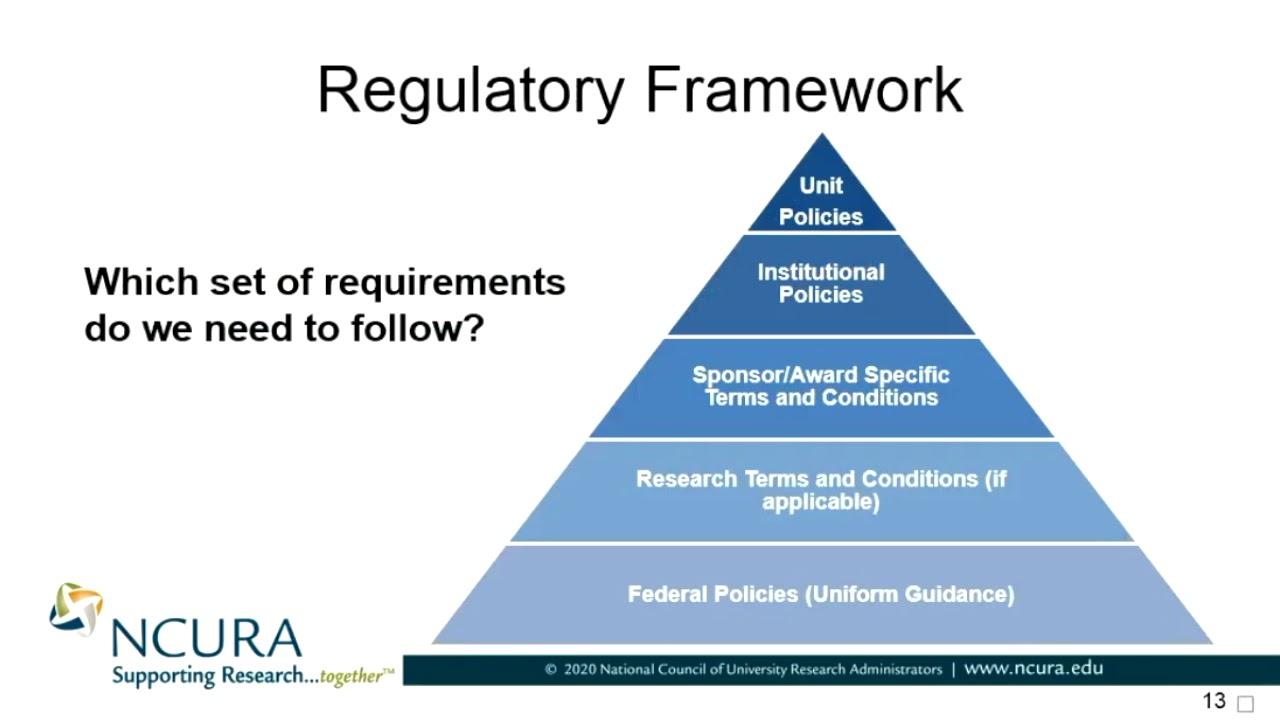

Regulatory Atmosphere and Alternatives for Expansion in Egypt

The regulatory panorama in egypt is gradually adapting to house the rising call for for Islamic finance.The Central Financial institution of Egypt is taking vital steps to reinforce the legislative framework, selling a extra conducive setting for Sharia-compliant monetary merchandise. Key projects come with:

- Established order of Regulatory Frameworks: New tips are being advanced to standardize Islamic banking practices, making sure they meet each Sharia ideas and global norms.

- Encouragement for monetary Inclusion: regulators are actively encouraging banks to increase their products and services to underserved populations, thereby expanding the full monetary penetration.

- Incentives for Innovation: The federal government could also be providing incentives for the advent of cutting edge monetary merchandise, aimed in particular at attracting a broader buyer base.

Those tendencies provide a large number of alternatives for monetary establishments.Particularly, the growth of Kuwait Finance Area into the Egyptian marketplace is a testomony to the expanding beauty of the Islamic finance sector. This access now not best indicates self assurance in Egypt’s financial setting but additionally highlights the possibility of expansion in Sharia-compliant products and services.The panorama is ripe for:

- Partnerships and Collaborations: Native banks and global Islamic establishments can shape alliances to proportion experience and assets.

- Funding in Fintech: With the upward thrust of virtual banking, there’s a urgent want for Sharia-compliant fintech answers that cater to tech-savvy shoppers.

- neighborhood Construction Initiatives: There’s a rising emphasis on financing tasks that advertise social welfare and construction, aligned with Islamic finance ideas.

Suggestions for Traders Taking a look to Navigate the Egyptian Marketplace

Traders aiming to capitalize at the alternatives throughout the Egyptian marketplace must undertake a multifaceted option to navigate its distinctive panorama. figuring out native laws is paramount, because the prison framework can range very much from different areas. Traders must keep knowledgeable about contemporary legislative adjustments and compliance necessities explicit to their sectors. Moreover, undertaking thorough marketplace analysis to spot trending industries will lend a hand to acknowledge high-potential funding alternatives. Key sectors lately thriving come with renewable power,actual property,and generation. Enticing with native mavens may give priceless insights into marketplace dynamics and shopper habits.

Moreover, forming strategic partnerships with Egyptian corporations can bridge the cultural and operational gaps that overseas buyers ceaselessly face. Taking part with native companies now not best facilitates smoother marketplace access but additionally complements credibility and native experience.buyers must additionally believe the significance of risk management methods adapted to the Egyptian context. This comes to assessing geopolitical elements and financial steadiness, in addition to diversifying portfolios to mitigate dangers. A proactive way in tracking financial signs and regional tendencies will empower buyers to make knowledgeable selections, maximizing their probabilities for luck in Egypt’s evolving marketplace panorama.

Long run Traits in Islamic Finance Following Kuwait Finance Area’s Enlargement

the new enlargement of kuwait Finance Area (KFH) into the Egyptian marketplace is poised to set in movement a chain of tendencies in Islamic finance that may affect the wider area. As KFH establishes its operations in Egypt, we will be able to look ahead to greater festival amongst islamic banks, which might reinforce product choices and buyer products and services. This enlargement indicators a rising reputation of Egypt as a pivotal marketplace,characterised by means of its distinctive demographics and a emerging passion in Sharia-compliant monetary answers. The combination of generation in banking products and services is extremely prone to boost up, with Islamic finance establishments making an investment in virtual platforms to seize a more youthful, tech-savvy clientele.

Moreover, we might witness a surge in collaborative ventures amongst Islamic monetary establishments around the area, aimed toward pooling assets and sharing easiest practices. Key tendencies prone to emerge come with:

- Higher Go-Border Collaborations: Banks might shape strategic alliances to reinforce their carrier portfolios and achieve a much broader target market.

- Center of attention on Lasting Financing: Given the worldwide emphasis on sustainability, Islamic finance establishments may prioritize eco-friendly tasks and socially accountable investments.

- Regulatory Improvements: Efforts to standardize laws and compliance frameworks throughout nations may just facilitate smoother operations for Islamic banks.

| Development | Affect |

|---|---|

| Technological Integration | Enhanced potency and buyer revel in. |

| Sustainable financing | Appeal of socially mindful buyers. |

| Collaboration Throughout borders | Advanced useful resource sharing and possibility control. |

To Wrap It Up

Kuwait Finance Area’s enlargement into Egypt marks an important construction within the realm of Islamic finance, highlighting the rising urge for food for Sharia-compliant monetary merchandise in a rustic poised for financial expansion. Because the financial institution units its attractions on tapping into Egypt’s burgeoning marketplace, this transfer now not best underscores its dedication to offering cutting edge monetary answers but additionally aligns with broader tendencies throughout the Islamic finance sector. Stakeholders shall be gazing intently to look how this strategic enlargement influences the aggressive panorama and fosters additional collaboration between monetary establishments within the area. Because the Islamic finance business continues to conform,Kuwait Finance Area’s endeavors might rather well function a catalyst for long run expansion and funding alternatives around the Arab international.

Source link : https://afric.news/2025/02/17/islamic-finance-roundup-kuwait-finance-house-expands-into-egypt-salaam-gateway/

Writer : Sophia Davis

Submit date : 2025-02-17 07:47:00

Copyright for syndicated content material belongs to the connected Source.