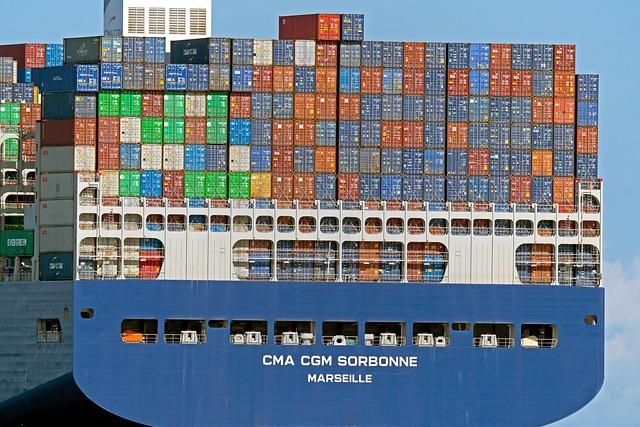

global supply chain disruptions and regional geopolitical tensions. as egypt navigates those turbulent waters,the results of reduced canal revenues lengthen past nationwide borders,affecting global industry dynamics and financial balance within the area.This newsletter delves into the criteria contributing to the Suez Canal’s income decline and the prospective repercussions for Egypt’s economic system and its position in international trade.

Egypt Reviews Vital income Losses from Suez Canal In keeping with Presidential Statements

In a up to date announcement, President Abdel Fattah el-Sisi highlighted the really extensive monetary have an effect on going through Egypt because of declining revenues from the Suez Canal. Per month losses are estimated at roughly $800 million, a staggering determine that underscores the essential position this maritime artery performs within the country’s economic system. The canal has traditionally been a vital supply of source of revenue, contributing to the most important international reserves.Alternatively, more than a few elements, together with international industry fluctuations and greater pageant from selection delivery routes, have contributed to this alarming decline in income.

To additional illustrate the magnitude of those losses, believe the next key issues:

- Strategic Significance: The Suez Canal connects Europe to asia, making it some of the important industry routes globally.

- Have an effect on on Industry: Disruptions in international provide chains have reduced site visitors in the course of the canal.

- Long term Investments: The Egyptian govt is exploring methods to spice up potency and draw in extra delivery site visitors.

| Month | Estimated Earnings Loss ($ thousands and thousands) |

|---|---|

| January | 800 |

| february | 800 |

| March | 800 |

Financial Have an effect on of Suez Canal Earnings Decline on Egypt’s Nationwide Price range

The decline in income from the Suez Canal, a very important artery for international industry and a vital contributor to Egypt’s nationwide funds, poses critical demanding situations for the rustic’s economic system. With reported losses approximating $800 million per thirty days,this downturn impacts govt source of revenue,making it increasingly more tricky to fund crucial products and services and infrastructure tasks. The Suez canal Authority’s monetary struggles may also be attributed to a number of elements together with shifts in international delivery routes, greater pageant from choice passages, and the lingering results of geopolitical tensions that experience derailed industry volumes.

As Egypt grapples with this monetary setback, the results lengthen past mere numbers. Financial balance could also be jeopardized, prompting possible measures akin to cuts in public spending or greater borrowing.The have an effect on of sustained income shortfalls may just manifest in more than a few tactics, together with:

- Diminished investment for social methods

- Higher inflation because of financial pressure

- Pressure on foreign currency echange reserves

- Possible delays in infrastructure building

To additional illustrate the commercial ramifications, the next desk outlines projected income affects over the following few quarters:

| Quarter | Projected Earnings Loss (in Million $) |

|---|---|

| Q1 | 2400 |

| Q2 | 2400 |

| Q3 | 2400 |

| This fall | 2400 |

Components Contributing to the Decline in Suez Canal Visitors and Earnings

The decline in site visitors in the course of the Suez Canal,resulting in vital per thirty days income losses,may also be attributed to various interlinked elements. World provide chain disruptions, in particular within the wake of the pandemic, have shifted industry patterns, inflicting fluctuations in delivery routes and schedules. Moreover, the continuing tensions in more than a few global markets have led to greater geopolitical dangers, prompting delivery firms to rethink their reliance on conventional routes. Othre contributing parts come with:

- Environmental Laws: Stricter environmental insurance policies are requiring delivery firms to spend money on cleaner applied sciences, resulting in possible delays and increased operational costs.

- Possible choices in Maritime Routes: Rising possible choices just like the Northern Sea Course have piqued passion, in particular as local weather trade reduces ice, offering a possible detour across the conventional Suez path.

- Financial Components: Prime gas costs and international inflation have strained logistics budgets, inflicting some firms to reduce and like slower, more cost effective delivery strategies.

Additionally, the aggressive panorama for delivery products and services has intensified, with different canals and delivery lanes vying for site visitors.The pandemic has speeded up shifts towards higher vessels, which, whilst expanding capability, complicate navigation and logistics in conventional spaces just like the Suez Canal.the next desk outlines the new traits affecting Suez Canal site visitors:

| Issue | Have an effect on on site visitors | Earnings implication |

|---|---|---|

| World Provide Chain Disruptions | Diminished delivery frequency | Lack of $200 million/month |

| Rising Selection Routes | Diverted delivery site visitors | Lack of $300 million/month |

| upper Operational Prices | Lengthen in transit occasions | lack of $300 million/month |

strategic Suggestions for Boosting Suez Canal Earnings Amidst Expanding Demanding situations

To make stronger income technology from the Suez Canal, a number of strategic tasks may also be carried out, taking into consideration the evolving maritime panorama and the emerging prices burdening delivery traces. First, adopting a tiered pricing construction according to the dimensions and form of vessels may just draw in extra site visitors whilst optimizing source of revenue. Incentives for operators who make a choice eco-kind routes or vessels may well be presented to align with international sustainability traits, serving to the canal stand out as a premier inexperienced delivery hall. Moreover, making improvements to the infrastructure and generation used for navigation and freight control throughout the canal may just scale back transit occasions and make stronger the whole experiance for delivery firms.

Every other road to reinforce income may just contain diversifying products and services presented throughout the Suez Canal’s operational zone. Via creating logistics hubs that supply warehousing, repairs, and service products and services, Egypt can trap delivery firms to believe the canal as a full-service path reasonably than a trifling passageway. Incorporating value-added products and services akin to customs facilitation and expedited shipment clearance can diminish ready occasions and inspire higher volumes of delivery site visitors. In combination, those measures may just create a strong financial ecosystem, making sure strong source of revenue flows even amidst a fluctuating international maritime marketplace.

Possible Lengthy-Time period Penalties of Sustained Earnings Losses for Egypt’s Economic system

The sustained income losses from the Suez Canal may have far-reaching implications for Egypt’s economic system. As probably the most country’s number one assets of foreign currencies, a constant shortfall of round $800 million per 30 days now not best constrains public funds but in addition raises issues relating to investments in infrastructure and social products and services. Possible long-term affects come with:

- Higher nationwide Debt: A decline in income would possibly pressure the federal government to borrow extra, resulting in a precarious fiscal scenario.

- Diminished Public Spending: With much less source of revenue, the federal government would possibly reduce on crucial products and services, which might lead to deteriorating healthcare and training methods.

- Foreign money Devaluation: Extended losses may have an effect on the price of the Egyptian pound, making imports dearer and using inflation.

Additionally, the commercial repercussions of constant income discounts are more likely to deter international funding, as self assurance in Egypt’s financial balance wanes. Possible fallout contains:

- Stagnant financial Enlargement: A drop in international direct funding can stymie expansion and innovation, perpetuating financial stagnation.

- Unemployment Charges at the Upward push: Task advent tasks would possibly stall, leading to upper unemployment and social unrest.

- Destabilization of Key Sectors: essential industries, in particular tourism and delivery, would possibly undergo long-term setbacks because of lowered financial task.

| Possible result | Have an effect on |

|---|---|

| Higher Nationwide Debt | Upper borrowing prices, imaginable financial instability |

| Diminished Public Spending | Deterioration of healthcare and training |

| Foreign money Devaluation | Inflation and better price of residing |

World Delivery Traits and Their Affect at the Long term of the Suez Canal Earnings

The panorama of world delivery has gone through vital adjustments in recent times, influenced through more than a few elements akin to evolving industry patterns and developments in maritime generation. As international provide chains adapt, delivery routes are being optimized for potency, which has direct implications for key issues of transit just like the Suez Canal. The upward thrust of mega-ships in a position to transporting huge volumes of shipment signifies that ports and canals should cater to bigger vessels,necessitating infrastructural improvements and navigation gadget upgrades. In consequence, a shift in call for towards exchange routes may just have an effect on the reliance on conventional passageways, striking added power at the Suez Canal’s income streams.

Additionally, geopolitical tensions and environmental laws are reshaping the dynamics of global industry. Components just like the implementation of stricter emissions requirements and the continuing shift towards sustainable delivery possible choices are prompting delivery firms to reconsider their operational methods. key issues influencing this development come with:

- Higher Center of attention on Sustainability: Delivery firms are making an investment in greener applied sciences, which would possibly impact routes to reduce emissions.

- Industry Agreements and Price lists: converting industry insurance policies can shift shipment flows and have an effect on Suez Canal utilization.

- Port Construction in Competing Areas: Rival canals and delivery lanes are rising, doubtlessly diverting site visitors clear of the Suez.

This confluence of traits would possibly problem the Suez Canal’s historical dominance but in addition items alternatives for adaptation and enhancement of products and services to safe long run income.Via making an investment in modernization and potency, the Suez Canal can handle its pivotal position in international industry, even amidst evolving delivery landscapes.

The Conclusion

the monetary repercussions of the suez Canal’s lowered site visitors have change into increasingly more glaring, with President Abdel Fattah el-Sisi revealing per thirty days income losses that approximate $800 million.The canal, a very important artery for international industry, has confronted demanding situations starting from geopolitical tensions to shifts in delivery routes. As Egypt navigates those turbulent waters, the federal government’s emphasis on bettering infrastructure and exploring alternative revenue streams will probably be the most important. The placement stays dynamic, and stakeholders will probably be intently tracking trends within the area as Egypt seeks to regain its financial footing amid those really extensive losses. Persisted consideration to the Suez Canal’s operational standing will probably be crucial in assessing now not best the native economic system but in addition the wider affects on global industry.

Source link : https://afric.news/2025/03/24/egypt-suez-canal-monthly-revenue-losses-at-around-800-million-sisi-says-reuters-com/

Creator : Charlotte Adams

Submit date : 2025-03-24 00:13:00

Copyright for syndicated content material belongs to the connected Source.